I was reading a recent post on AdExchanger, “Smoking the RTB Weed,” about a Real-time bidding paper Metamarkets was gearing up to present at an industry event and it got me thinking about dynamic price floors (n.b. If you’re not already familiar with RTB, you might want to start with my earlier post on the topic to get up to speed. This post is pretty ‘inside baseball.’)

Disparity of Data

There’s a lot concern in the online ad ecosystem around the disparity of data between publishers and advertisers. These are not new concerns but they are attracting a lot of attention due to the opportunity that Real-Time Bidding (RTB) presents in leveling the playing field.

Historically advertisers have been incentivized to understand the audience behind the publisher in order to maximize their yield. This has led to a large investment in technology to serve the advertiser, tilting the balance of information to their favor and leading to rampant arbitrage. As a result, most impressions are still sold without adequate protection.

Re-balancing Toward the Publisher

Real-Time Bidding affords the publisher an opportunity to re-balance the terms of the sale of inventory. In fact, in many ways the savvy, well-armed publisher can leverage RTB to gain an advantage in that each impression is evaluated and assigned a value by several buyers.

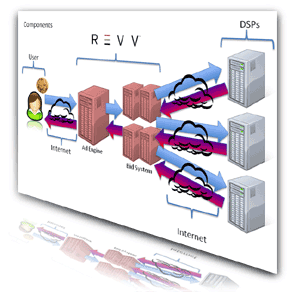

During an auction only one buyer can purchase the impression, but the data gathered from the other buyers is not discarded, rather it is captured by the publisher (or in our customers’ case, by REVV) and stored for analysis and pricing determination on all future bids. Read more