I can answer some of these questions, but I won’t go into specifics about the percentages since I can only really give you insight into one company with any confidence.

SSP

On the SSP side the revenue model is based on a percentage of revenue flowing to the publisher. This works well as it lines up the SSP’s incentives with the publisher. The more money the publisher makes – the more money the SSP makes. SSP’s are generally geared toward serving the publishers so that alignment makes for a good relationship.

DSP

On the DSP side I know of two prevalent revenue models. The most prevalent has profits tied to a percentage of spend. This is taking money the same way the SSPs do, so it requires the advertisers that use the DSP to trust that all the algorithms and technology is: A – getting them a good price, and B – fulfilling the requirements of the campaign in the most optimal way. The major DSPs seem to have a good handle on these two elements and appear to be doing fine, even though the financial model doesn’t inherently lend itself to support “A”. Read more

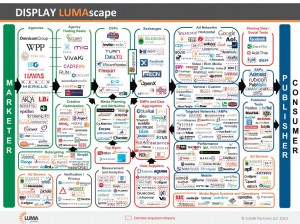

Bernhard Glock of Medialink, who was not on the panel, but chimed in with a profound thought. Buying on television is buying something that’s familiar, with seemingly known or at least comfortable impact and expectations on results. By contrast, buying online display is a complete mystery. His solution, just buy on television because that’s what he understands.

Bernhard Glock of Medialink, who was not on the panel, but chimed in with a profound thought. Buying on television is buying something that’s familiar, with seemingly known or at least comfortable impact and expectations on results. By contrast, buying online display is a complete mystery. His solution, just buy on television because that’s what he understands.