This is the first in a series of posts walking readers through the mobile advertising space. Stay tuned for more posts over the coming weeks. This is also posted on the Rubicon Project blog.

Fixing Mobile

Everyone recognizes that mobile advertising is a rapidly growing market. How fast is it growing? eMarketer has current year revenue estimates at $3.9 Billion. According to the Yankee Group mobile ad sales should nearly triple by 2016 to $10 Billion. I think this estimate is low given the acceleration in market growth we’ve experienced so far this year alone. Revised eMarketer numbers now indicate nearly 100% growth for 2012 over 2011. Further, eMarketer predicts that mobile will grow to over $23 Billion by 2016. This is much more consistent with Mary Meeker’s prediction of a $20 Billion mobile market.

Given this tremendous market opportunity, we have seen first-hand that numerous publishers are moving to mobile – building mobile applications, optimizing their web content and trying to figure out how to turn that mobile content into a dependable revenue stream. We are glad publishers are jumping in and are excited to be in the mobile space as well. However, we have also witnessed headwinds in this developing market and would like to use this blog to help publishers address these challenges.

The mobile display advertising space has some distinct challenges that fly in the face of the status quo of online display. These challenges conspire to make it more difficult for publishers to advertise across their mobile inventory. A primary complication is that there are three major operating systems (plus Blackberry), each with subtle differences that require research and technology to overcome. Let’s explore how each of these platforms differ.

Apple’s iPhones do not support Flash and ship with third party cookies disabled by default. The lack of Flash strongly affects the user experience and the ability to deliver Flash-based rich media creatives that render in online display (troublesome on iPad, where standard display ads are typically viewed with little loss of fidelity relative to their online counterparts). Additionally, the lack of third party cookies makes it difficult to perform simple audience targeting that we’ve grown accustomed to.

Microsoft’s Windows Phone 8 platform is touted as having twice as much HTML 5 support, but still lags behind Chrome (Android), Safari (iOS) and even Blackberry. We are hopeful that Windows Phone 8 will support HTML 5 to the point that publishers and advertisers can leverage the same mobile web ads across platforms. However, there is a possibility that a lack of full HTML 5 support will require custom ad units for this platform. On top of that, Windows Phone 8 may also ship with the new Do Not Track (DNT) flag turned on, severely limiting the ability for publishers to achieve higher rates through traditional tracking and targeting.

Google’s Android platform seems to be the most compliant to the needs of the industry. Android supports 3rd party cookies, DNT is disabled by default, device IDs are available in the app environment and it even supports Flash. Of course this all supports Google’s advertising business, but they’re nice enough to keep the platform open for a variety of complementary and competitive third parties. By creating an environment most closely resembling online display, Google has made it easier for publishers to incorporate Android to their mobile experiences.

Where does all of this fragmentation leave us? Many publishers have been successful in traversing this fragmented market. If you are new to mobile, it can be daunting to figure out where to start. A logical starting point is to figure out what mobile devices are most common among your audience and focus on building your mobile presence there (at least initially). That way you limit the number of challenges you have to deal with. Eventually you will have to accommodate users across a variety of devices and platforms, so working with a partner that is platform-agnostic is critical. Look for partners that have a history of ad serving across platforms and formats.

In this series of posts, I hope to help provide some insights to help publishers that are still trying to make sense of the market. What challenges do you face in mobile? What specifically would you like insight and tips on? Comment below and I’ll incorporate into the subsequent posts.

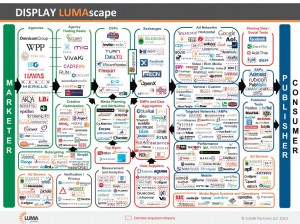

The primary customer of the Supply Side Platform is the publisher. Most features are geared toward publisher needs. Access to demand is the paramount feature. Maximizing publisher yield over the long-term is also critically important. Companies that were already yield optimizers have taken the lead in the online display SSP space.

The primary customer of the Supply Side Platform is the publisher. Most features are geared toward publisher needs. Access to demand is the paramount feature. Maximizing publisher yield over the long-term is also critically important. Companies that were already yield optimizers have taken the lead in the online display SSP space.

In a typical RTB transaction there’s a user ID, pulled from the user’s cookie or some form of server side system, which is passed to the DSP from the SSP. That ID is, in most cases, the DSPs record locator for the user’s information. Most DSPs have a server side data store where this information is housed, updated and augmented from a variety of sources including data companies like Blue Kai and Excelate and their ilk. DSPs may also be collecting and distilling information based on bid request activity from that user (although most SSPs put language into the contracts governing the use of this “bid stream” data) or retargeting data gathered for their customers. This type of data system is generally referred to as a Data Management Platform (DMP) in the industry. While there are some stand-alone DMPs out there, more and more DSPs are integrating or building their own.

In a typical RTB transaction there’s a user ID, pulled from the user’s cookie or some form of server side system, which is passed to the DSP from the SSP. That ID is, in most cases, the DSPs record locator for the user’s information. Most DSPs have a server side data store where this information is housed, updated and augmented from a variety of sources including data companies like Blue Kai and Excelate and their ilk. DSPs may also be collecting and distilling information based on bid request activity from that user (although most SSPs put language into the contracts governing the use of this “bid stream” data) or retargeting data gathered for their customers. This type of data system is generally referred to as a Data Management Platform (DMP) in the industry. While there are some stand-alone DMPs out there, more and more DSPs are integrating or building their own.